Machine Learning (ML) is a sub-discipline of artificial intelligence (AI) and a powerful tool that has versatile applications. ML has been successfully applied to robotics, image recognition, speech recognition, natural language processing (NLP), and many other fields. ML is suited to applications which involve highly complex decision-making based on cloud-scale datasets. The fintech arena abounds with complex decisions, and is the perfect platform to apply ML.

Self-driving cars and personalized banking

ML is the process by which computer algorithms improve themselves. They do so by repeatedly making decisions based on input data and output criteria. The objective of the decision is to maximize the output variable. ML programs can do this with or without human supervision. Larger and more comprehensive input datasets lead to better trained ML algorithms. A self-driving vehicle is the perfect example of an ML application. Its objective is to avoid collisions while reaching the destination efficiently. A training dataset can teach the algorithm how to respond to traffic, pedestrians, road obstacles, potholes, traffic signals, and weather conditions. Once it is sufficiently trained the self-driving algorithm can be installed on production cars and can keep improving itself. This can potentially result in better road safety, better fuel efficiency, less congestion, and more comfort. Now let’s take a look at how this is relevant to banking.

Risk mitigation is one example of an ML application in fintech. Fraud detection, like driving, is a function of processing multiple complex variables to make good decisions. A self-driving program prevents accidents by forecasting and avoiding collisions. Similarly ML in fintech is helping forecast and avoid fraud. And it doesn’t stop there. Using records of billions of past transactions as training datasets ML programs can evaluate complex clusters of indicators to generate a highly accurate ‘risk score’ for each customer. This information helps identify which products would suit them best. In this way ML is enabling fintech firms to offer highly tailored banking services while reducing risk.

Smart investing

Another fintech domain with high complexity is predicting stock market movements. Traditionally banks and financial institutions have relied on experienced people known as ‘fund managers’. However, the amount of variables that influence stock prices are beyond the capacity of purely human evaluation. This is why so many mutual funds and unit-linked investments perform unpredictably. ML-powered programs can efficiently process multitudes of variables quickly. They can handle vast amounts of data in real-time and give reliable stock price predictions every time. Plentiful historic stock price data already exists. Using this data to train ML predictors can make them highly effective.

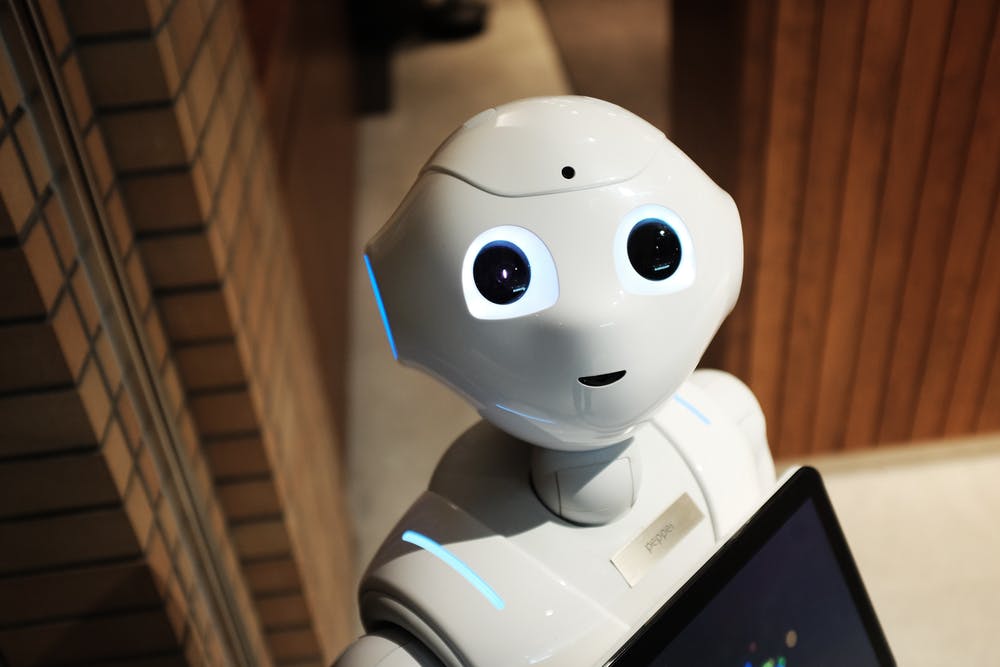

Robo-advisors

ML-powered robo-advisors are playing increasingly important roles in customer service, wealth management, insurance, loans, savings, and personal finance. Robo-advisors are consistently more accurate than human advisors, and cost less. Some robo-advisors exist as chat bots on fintech sites. Others are available 24/7 as mobile apps. Customers can get highly personalized advice simply by inputting their financial data, risk preferences, and goals. The collective value of funds managed by robo-advisors already amounts to several billion dollars, and is on the rise. Some analysts have calculated that the amount of wealth managed by ML-powered applications will overtake human-managed wealth within 5 years.

Remittances

The average global cost of sending cross-border remittances is just under 6%. This represents almost $45 billion annually. Most of this cost is banks’ fees for currency conversion. It is potentially possible to minimize this cost by balancing the bilateral flow of remittances across international borders. For example, an international money transfer for EUR 100 is sent from Germany to Denmark. During the same period another transfer for EUR 100 is sent the other way, from Denmark to Germany. An AI aggregator can match these amounts and cancel them out. There would be no need for any actual cross-border movement of money or its associated costs. Senders in both countries could simply route the money to the aggregator, and both recipients would get it. The challenge is to effectively apply this to millions of transactions per day. With the proliferation of smartphones the infrastructure to make this possible is already in place. ML-powered applications can make it a reality.

In conclusion

Machine learning is essentially a statistical tool that helps make accurate predictions from available data. Entrepreneurs, managers, and investors can use these predictions to make effective decisions and improve ROI. Several ML applications are already in mainstream use in various fintech domains. However, we have barely scratched the surface. ML is still evolving. It has vast potential to reduce costs, spur financial inclusion, and improve lives.

About the author:

Hemant G is a contributing writer at Sparkwebs LLC, a Digital and Content Marketing Agency. When he’s not writing, he loves to travel, scuba dive, and watch documentaries.